50/30/20 vs. Zero-Based Budgeting: Which is Better?

Budgeting is one of those words that can either feel empowering or intimidating. For many people, it brings to mind restriction and sacrifice. But in reality, a budget is not about limiting your life — it’s about giving every dollar a purpose so your money reflects your values.

Two of the most popular budgeting methods are the 50/30/20 Rule and Zero-Based Budgeting. Both can help you organize your finances, but they take very different approaches.

What is the 50/30/20 Rule?

The 50/30/20 Rule is a simple framework for dividing your after-tax income:

- 50% Needs – housing, food, utilities, transportation, insurance, and other essentials.

- 30% Wants – dining out, travel, entertainment, hobbies, and lifestyle spending.

- 20% Savings & Debt Repayment – retirement savings, emergency fund, extra debt payments, or other financial goals.

Its appeal lies in its simplicity. You don’t need to track every transaction in detail — just keep your overall spending within these broad categories.

Pros of the 50/30/20 Rule

- Simple & Accessible – great for beginners who feel overwhelmed by money management.

- Quick Snapshot – shows whether you’re living within your means at a glance.

- Flexible – leaves room for personal choices in “wants” without guilt.

Cons of the 50/30/20 Rule

- Too General – doesn’t account for individual differences (for example, someone in a high cost-of-living area may need 70% for “needs”).

- Limited Insight – doesn’t reveal where overspending actually happens.

- Passive Approach – may not actively align your spending with your values and goals.

What is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) takes a more intentional approach. Instead of assigning rough percentages, you give every dollar a job. That means your income minus expenses equals zero — not because you spent it all, but because you assigned it all.

For example:

- $3,000 income

- $1,500 housing & utilities

- $500 groceries & transportation

- $300 debt repayment

- $400 retirement savings

- $300 emergency fund

Formula = $3,000 -$1,500 – $500 -$300 – $400 – $300 = $0

Nothing is “left over” without a plan.

Pros of Zero-Based Budgeting

- Clarity & Control – you see exactly where your money is going.

- Goal-Driven – aligns daily spending with long-term priorities.

- Adaptable – can flex with life changes, big or small.

- Intentional Living – encourages you to think about whether each dollar reflects your values.

Cons of Zero-Based Budgeting

- More Time-Intensive – requires closer tracking than 50/30/20.

- Can Feel Restrictive – some may resist the structure if they’re not ready for detail.

Why We Choose Zero-Based Budgeting

At WISE360, our philosophy is rooted in purposeful living. Money is not just about meeting needs or indulging wants — it’s a tool for creating a life aligned with your values and vision.

The popular 50/30/20 Rule can be a great starting point, especially for beginners. But its broad categories don’t always go deep enough. Zero-Based Budgeting (ZBB), on the other hand, invites you to be fully intentional. Every dollar is given a job — whether that’s building financial security, funding a dream, or giving generously.

When you master your money, you’re not just balancing numbers — you’re shaping your life. That’s why ZBB resonates so deeply with us: it’s not about control for control’s sake; it’s about freedom, clarity, and living with intention.

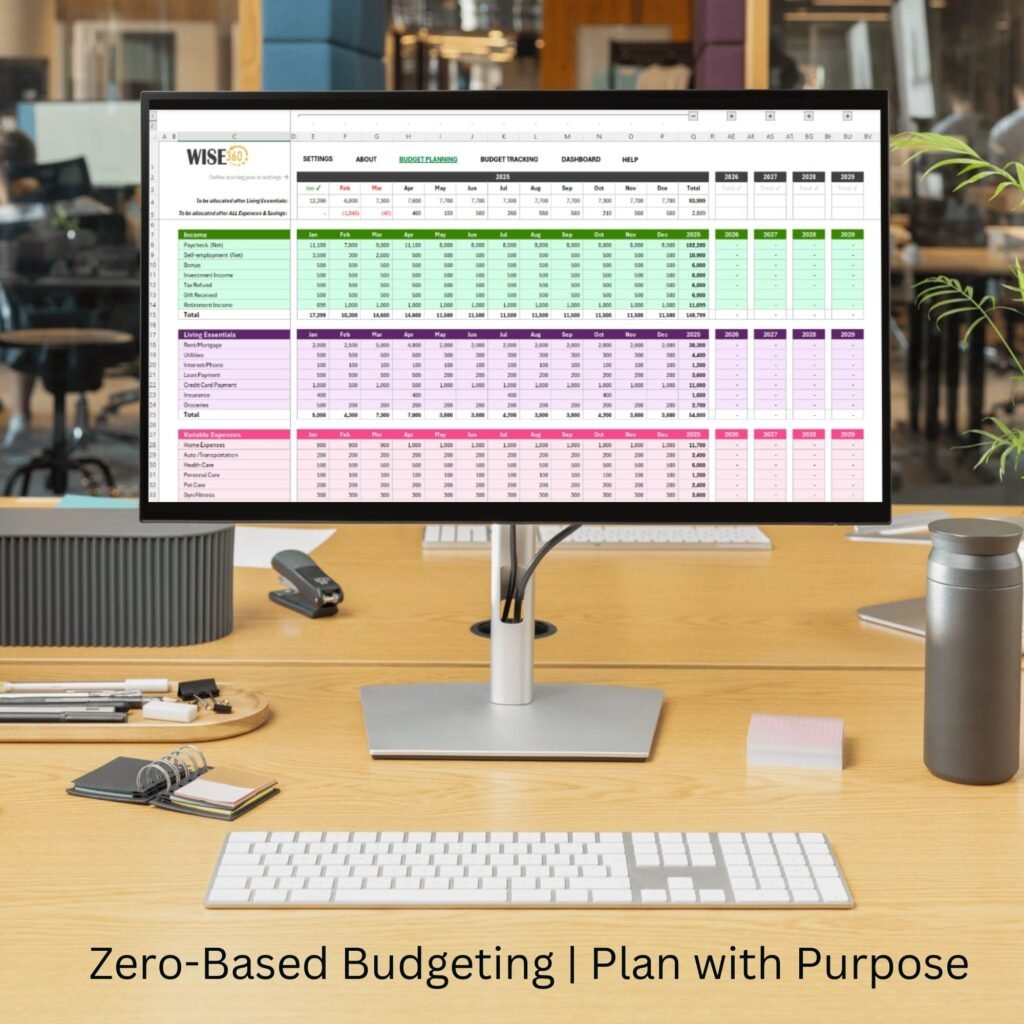

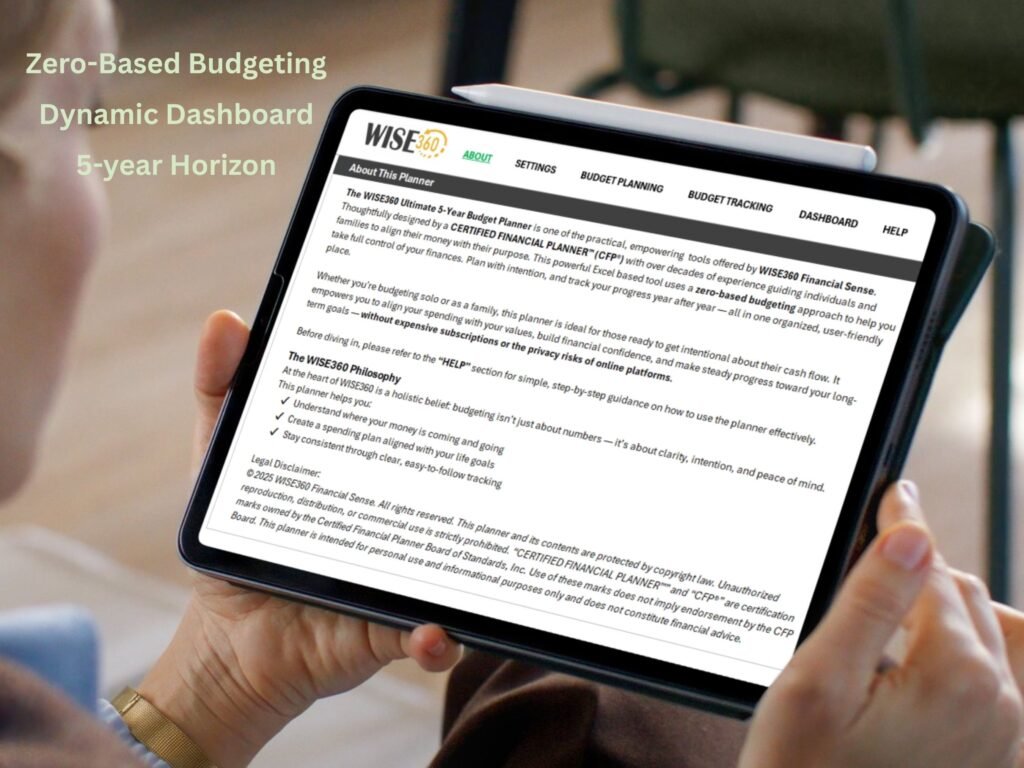

To make this process simpler, we designed the WISE360 Ultimate 5-Year Budget Planner — a practical tool that walks you through Zero-Based Budgeting step by step. It’s more than a spreadsheet; it’s a framework for building financial confidence and aligning your money with what matters most.

👉 Ready to see the difference purposeful budgeting can make? Explore the WISE360 Ultimate Budget Planner and start shaping your life with intention today.

Your financial journey doesn’t stop here.

Be the first to get new tools, free resources, and simple strategies for mastering your money. Join our WISE Circle today and start living with clarity and intention.