The 5-Year Financial Planning Philosophy: Why It Works and How to Apply It

Why 5 Years Matters in Money and Life

When it comes to personal finance, most people think in extremes: either short-term monthly budgets or long-term retirement planning. But there’s a powerful middle ground that often gets overlooked—the 5-year horizon.

Five years is long enough to make significant financial progress, yet short enough to feel tangible and motivating. It provides clarity, structure, and balance between where you are today and where you want to be in the near future.

This 5-year perspective isn’t unique to financial planning. In the bestselling book Designing Your Life, authors Bill Burnett and Dave Evans encourage readers to create “Odyssey Plans” — three different visions of what life could look like over the next five years. Their approach reinforces the same idea: five years is a powerful window of time to imagine possibilities, set goals, and make meaningful progress without feeling overwhelmed.

The Psychology Behind a 5-Year Plan

Tangible Milestones

Unlike a 10- or 20-year vision that feels abstract and distant, a 5-year plan breaks the journey into achievable checkpoints. With shorter milestones, you can measure progress along the way, whether it’s saving a set amount, reducing debt, or investing in a new skill. These small victories keep momentum high and give you confidence that you’re on the right track.

Life Transitions Fit Naturally

Major life events often unfold in cycles of 3–5 years. Buying a home, starting a family, changing careers, or launching a business rarely happen overnight. A 5-year framework creates a natural container to plan for these transitions. Instead of being caught off guard, you can prepare financially and emotionally, making these big changes smoother and less stressful.

Keeps Motivation High

When goals feel too far away, motivation often fades. Five years provides just the right amount of urgency—close enough to feel attainable, yet long enough to make meaningful changes. Knowing there’s a clear finish line within reach helps you stay committed, while the flexibility of the timeline prevents burnout or overwhelm.

The Financial Benefits of a 5-Year Framework

Debt Reduction With Purpose

High-interest debt can feel overwhelming if you only focus month to month. A structured 5-year plan allows you to align debt repayment with your life goals—whether it’s eliminating student loans, credit card balances, or a car loan. By spreading payments strategically, you can accelerate progress without sacrificing other financial priorities.

Building Emergency Reserves

Financial resilience doesn’t happen overnight. By spreading savings goals across a 5-year window, you can steadily build an emergency fund that protects you from unexpected expenses. This approach avoids the pressure of saving everything at once while still ensuring you reach a level of security that reduces financial stress.

Investing With Clarity

Many people struggle to balance short-term needs with long-term investing. A 5-year framework bridges that gap. It helps you decide how much to allocate toward safety (like maintaining healthy cash flow) and how much toward growth (like retirement accounts or investments). With this clarity, each dollar has a purpose aligned with both today and tomorrow.

Adapting to Change

Life rarely goes exactly as planned. A 5-year approach gives you a flexible structure that can be recalibrated if circumstances shift, such as a job change, family addition, or unexpected expense. Instead of starting over, you simply adjust the course and keep moving forward. This adaptability makes the plan resilient, helping you maintain momentum no matter what life brings.

How to Create Your Own 5-Year Plan

- Define Your Priorities – Ask yourself: What do I want my life to look like in five years?

- Set Specific, Measurable Goals – “Save $60,000 for a down payment” is stronger than “Save for a house.”

- Explore Multiple Paths – Borrowing from Burnett & Evans’ “Odyssey Plan,” imagine three different versions of what your next five years could look like. Compare them to see which path excites and aligns with your values.

- Align Money With Values – Budgeting isn’t about restriction; it’s about funding what matters most.

- Track Progress Regularly – A quarterly check-in keeps you on course without micromanaging.

Why WISE360 Built a 5-Year Planner

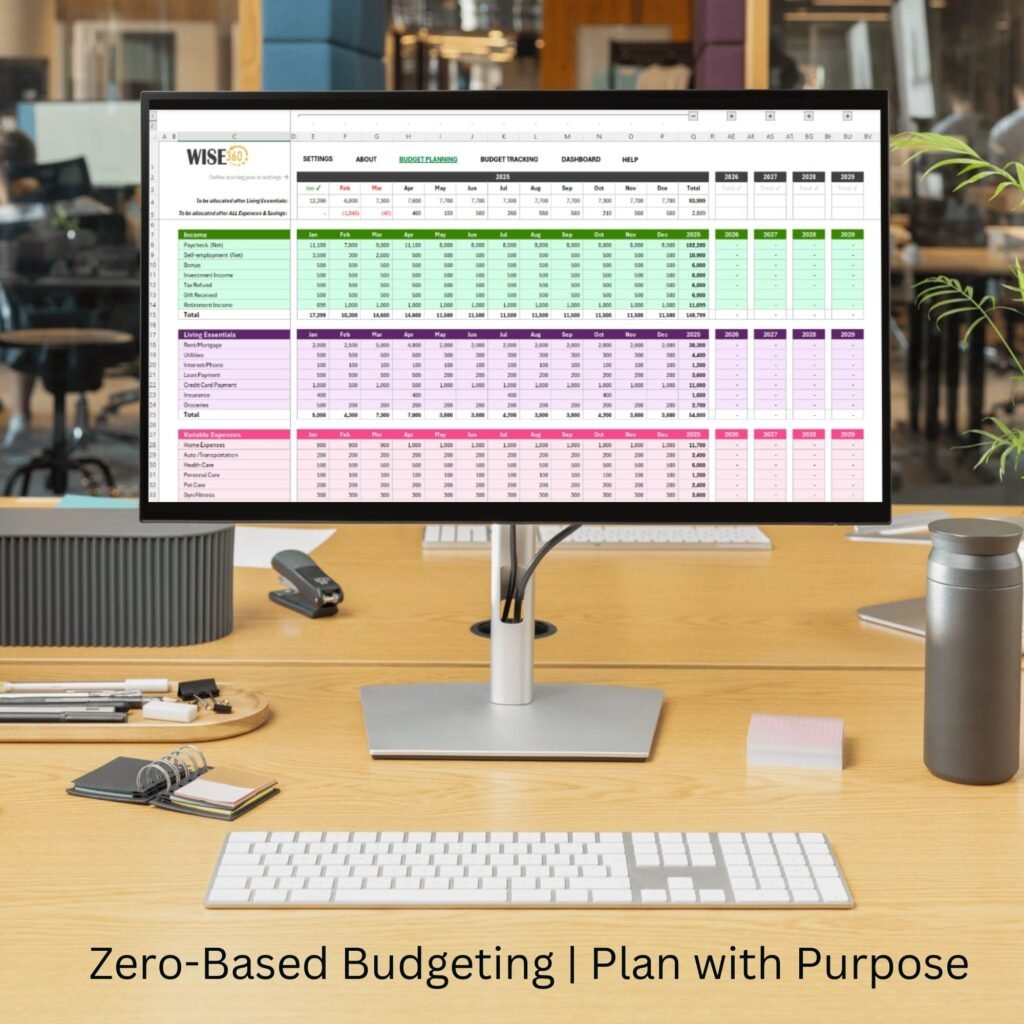

At WISE360 Financial Sense, we believe that true financial wellness is about balance—living fully today while preparing wisely for tomorrow. That’s why we designed the WISE360 Ultimate 5-Year Budget Planner, a digital tool created by a CERTIFIED FINANCIAL PLANNER™ with nearly two decades of experience.

Unlike traditional monthly budget templates, our planner helps you:

- See your financial journey mapped across five years.

- Plan for both expected milestones and life’s surprises.

- Build healthy money habits through innovative categories and intuitive dashboards.

Take Control of the Next Five Years

If you’re ready to bring the 5-year philosophy into your own life, the WISE360 Ultimate 5-Year Budget Planner is available now in Excel format. For less than It’s more than a budget—it’s your personal roadmap to clarity, confidence, and financial freedom.

As Burnett & Evans remind us in Designing Your Life, the next five years will pass no matter what. The question is: will you design them with intention, or let them drift by?

Your financial journey doesn’t stop here.

Be the first to get new tools, free resources, and simple strategies for mastering your money. Join our WISE Circle today and start living with clarity and intention.