One Step at a Time: How Small Steps Lead to Big Life and Financial Wins

Introduction: The Power of Taking One Step at a Time

The Via Francigena, a timeless path of faith, endurance, and self-discovery has carried pilgrims across Europe for centuries. Every step along its path stands a testament to patience, persistence, and purpose. In many ways, life and money follow the same rhythm. Just as pilgrims reached Rome one step at a time, we too can achieve our greatest dreams, whether walking a trail, building resilience, or pursuing financial freedom. That’s the essence of One Step at a Time Financial Planning – breaking down overwhelming goals into small, consistent actions that compound over time and lead to lasting results.

In today’s fast-paced world, we often crave instant success. But the truth is, meaningful growth, whether in health, relationships, or finances, rarely happens overnight. Instead, it unfolds one step at a time.

Our Training Journey: Building Endurance Mile by Mile

Inspired by the spirit of countless pilgrims who have walked the Via Francigena for hundreds of years, my husband Kevin and I are preparing to walk from Lucca to Siena this coming October. To prepare ourselves for this journey, we have been training every day for the last six weeks—starting with a mile and slowly increasing our distance.

Yesterday, we completed our longest hike ever – over 12 miles on Bull Run Fountainhead Trail. by the end, my body was depleted. This morning, I wanted the next morning was nothing more than to rest. Yet Kevin suggested we walk another eight miles. I didn’t think I could walk even one, let alone eight. Still, I couldn’t argue with his persistence and joy. Reluctantly, I agreed on the condition that I would listen to my body and adjust if necessary.

Fueled by a nourishing brunch, and with equipped with plenty of water and snacks, we set out again, this time to Accotink Trail, a path new to us. To my surprise, it was a delight—shaded by tall, mature trees, the air cooler beneath their canopy. The trail connects to the Fairfax County Trail, which stretches more than forty miles. The conditions were perfect for a summer walk, and after three hours, we had completed almost nine more miles. (You can learn more about this trail at Fairfax County official website.)

Walking more than twenty miles in just two days was, without a doubt, a challenge. Yet it also became a powerful reminder: what once felt impossible can become achievable one step at a time.

Lessons from the Trail

We Are Stronger Than We Think

Our limits often exist only in our minds. On the trail, I discovered that when fatigue set in, my body was capable of more than I believed if I just focus on putting one foot in front of another. The moment I pushed past doubt and took another step, I found the strength to move forward.

This is true in life as well. Often, we hesitate to start a big project, chase a dream, or face our financial challenges because we convince ourselves it’s too hard. But strength doesn’t appear before the journey—it reveals itself as we walk. Every debt payment, every mile, every new skill learned prove that we are capable of far more than we imagine.

Mindset is Everything

The difference between giving up and moving forward often comes down to mindset. On long hikes, the miles felt overwhelming when I focused on the total distance. But when I shifted my mindset to simply reaching the next tree, the next bend in the trail, the journey felt lighter.

Similarly, in One Step at a Time Financial Planning, mindset shapes everything. If you focus only on the big picture—paying off thousands in debt or saving for retirement—it can feel crushing. But when you reframe your thinking toward small wins—a single bill paid, $50 saved—momentum builds. A positive mindset doesn’t just make the journey bearable; it makes it possible.

The Importance of Support and Accountability

No one reaches their destination alone. During our hikes, Kevin was more than a walking partner; he was my encourager, coach, and comedian. When my energy ran low, he reminded me why we started. When my spirit faltered, he lifted it with laughter by singing silly songs like “99 bottles of beer on the wall” until we were both smiling. His presence made the impossible achievable.

This mirrors our financial journeys. Just as an accountability partner lightens the miles, having support in money matters keeps us consistent. Whether it’s a spouse, a financial planner, a trusted friend, or even a tool like the WISE360 Ultimate 5-Year Budget Planner, accountability provides the push we need when motivation runs thin. Alone, the path feels heavy; together, we find the strength to carry on.

Small Steps Create Big Changes

Dreams are often distant and intimidating, whether it’s walking a 1,000-mile pilgrimage or saving enough to retire comfortably. Looking at the full distance can make us want to quit before we even begin. But the secret is this: progress is built on small, steady steps.

On the trail, one mile turned into twenty. In finances, one saved dollar becomes hundreds, then thousands, through patience and consistency. Each small choice—skipping an unnecessary purchase, making an extra loan payment, investing in a retirement account—compounds into meaningful results over time.

This is the core of One Step at a Time Financial Planning. You don’t have to conquer the entire journey today. All you need is one step, then another, then another. Eventually, those small steps become the foundation of big, lasting change.

Financial Planning as a Journey: One Step at a Time

The Weight of Financial Burdens and Long-Term Goals

Finances, much like a long-distance walk, can feel overwhelming at the start. The weight of debt, the uncertainty of emergencies, or the complexity of planning for retirement can press down like a heavy backpack. Many people feel paralyzed, unsure of where to begin, because the finish line seems so far away.

But financial planning doesn’t require giant leaps. Instead, it requires recognizing the weight you’re carrying and committing to lighten the load one step at a time. By creating a simple plan, you turn uncertainty into direction, and the impossible begins to look possible.

Small Wins Add Up: Savings, Payments, and Habits

One of the most rewarding parts of a financial journey is realizing how quickly small wins create momentum. A single debt payment may feel like a drop in the ocean, but consistent payments reduce balances faster than expected. A small emergency fund—just $500 or $1,000—may seem modest, but it provides the confidence to face unexpected expenses without panic.

In One Step at a Time Financial Planning, these small, deliberate actions accumulate. Savings grow, debts shrink, and financial freedom slowly comes into focus. Much like tracking miles on a trail, seeing your progress on paper reminds you that you’re moving forward, even if the destination is still ahead.

Accountability Matters in Finances Too

On a trail, hiking with someone else helps you keep pace. In finances, accountability plays the same role. Without it, it’s easy to stray off course—skipping a budget check-in, overspending, or losing sight of long-term goals.

This is where tools and partners matter. A budgeting app, a planner, or even a trusted friend can act as a compass, keeping you on track when distractions arise. By checking in regularly and measuring progress, accountability transforms vague goals into steady forward motion.

Tools for the Journey: WISE360 Ultimate 5-Year Budget Planner

Building Money Habits with Intention

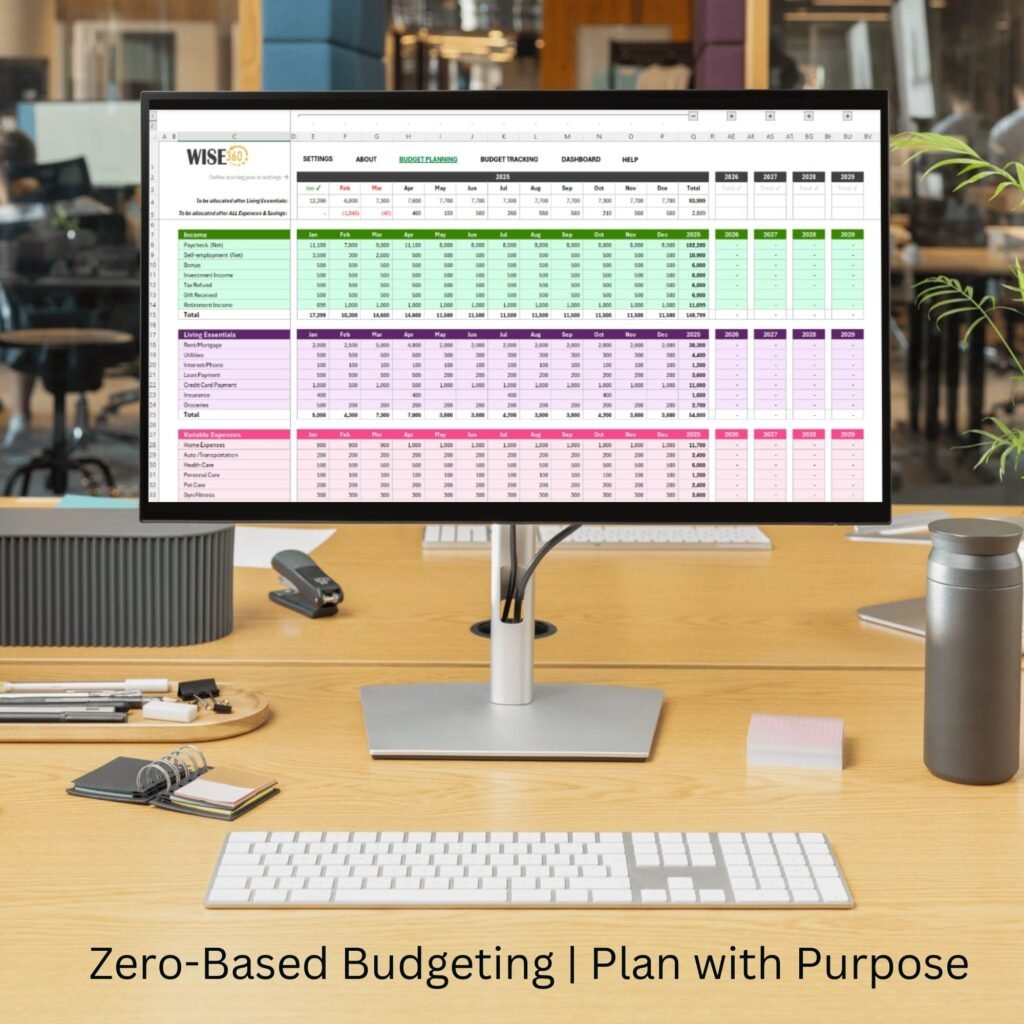

Every journey requires the right equipment. On the trail, water, good shoes, and a map make the difference between finishing strong and giving up early. In the financial world, the WISE360 Ultimate 5-Year Budget Planner serves the same purpose: it equips you with the clarity and structure to stay the course.

This planner isn’t about restriction—it’s about intention. By helping you set priorities, track your progress, and plan for what matters most, it transforms vague goals into tangible steps. With each entry, you create a habit of mindfulness around money, ensuring that every dollar has a purpose.

Tracking Progress and Celebrating Milestones

One of the most powerful motivators on any journey is seeing how far you’ve come. Just as hikers mark their distance on a trail, the WISE360 planner allows you to measure your financial progress month by month, year by year.

Did you save an extra $100 this month? Pay off a lingering credit card balance? Build your emergency fund? Each of these milestones deserves recognition. Tracking them inside the planner not only keeps you organized but also fuels your motivation to keep going. Small victories, when acknowledged, become the stepping stones to larger successes.

At WISE360, we believe money is more than numbers — it’s a tool to help you live fully, navigate life’s transitions, and create wealth that goes beyond money. We offer practical financial tools, empowering financial literacy resources, and inspirational WISE360 Lifestyle merch to make mindful money practices part of everyday life.

Want to bring these insights into your own journey? Join the WISE Circle — our free community where mindful money, financial confidence, and purposeful living come together.